Source

Another great representation of the amazing loss of purchasing power by the US public are today’s oblivious statements about the Dow at 10,000. While in absolute terms the Dow may cross whatever the Fed thinks is a necessary and sufficient mark before QE begins to taper off (Dow crosses 10k just as Treasury purchases expire), the truth is that over the past 10 years (the first time the DJIA was at 10,000) the dollar has lost 25% of its value. Therefore, we present the Dow over the last decade indexed for the DXY, which has dropped from 100 to about 75.

On a real basis (not nominal) the Dow at 10,000 ten years ago is equivalent to 7,537 today! In other words, not only have we had a lost decade for all those who focus on the absolute flatness of the DJIA, but it is also a decade where the US Consumer has lost 25% of purchasing power from the perspective of stocks! You won’t hear this fact on the MSM.

.

Money: A Semi Pictorial Fable

By Jeff Harding

The Daily Capitalist

We have forgotten what money is.

Money is really easy to understand, but most people have no idea what it is. We all understand that barter is an inefficient way to foster economic growth and money is a good thing for the economy. But money isn’t a piece of paper.

Let me create a kind of fable to illustrate this. Please bear with me here. Think of this as an amusing weekend read.

Imagine an big isolated valley in a simple rural, pre-technology society, centuries past. People get up in the morning, farm, hunt, build homes, makes clothes, babies, cook meals, think of ways to defend the perfect valley, party, the usual stuff. Human nature being what it is, some people are better at some things than others.

Enter George. George hates farming and isn’t very good at it. But he loves to tinker and invents the plow which makes him much better at farming even though everyone knows he stinks at it. His neighbor John notices George’s sudden farming success and asks George to make him a plow. George says he doesn’t have time, he needs to farm, save grain for the winter, yadda yadda yadda. John says “I’ll give you some grain if you make me a plow.” It didn’t take George long to see the opportunity and now he just makes and sells plows, eats well, brings his kids into the family business, forgets farming, and life is good. Barter and specialization of labor is invented.

What has happened here economically? Well, John had to save up some grain and not eat it to get the plow. This is called capital or real savings. Remember this; it’s key.

Everyone hears about plows and George expands his business. He now has grain bursting from his barn. He notices that farmers have a lot of grain that year. He has so much grain that he can’t trade the grain fast enough for stuff he wants, and it spoils. Not good for George.

George thinks about his problem and notices that everyone likes gold jewelry: it doesn’t spoil, tarnish, rust, it’s pretty, scarce, and easily workable. People seem to covet the stuff. He has an idea. He sends George Jr. out to trade as much of the excess grain as he can for gold. George then purifies it and makes round disks of uniform weight and size. Yes, coins. Be patient, I have a point.

You know what happens. He starts using coins to buy things he needs for his business, and because everyone trusts George, they recognize that gold is valued and they accept them in exchange for goods. Pretty soon the coins are spreading through the community and the economy grows. It’s so easy to trade for other things by using the coins. George also makes a little bit on each coin he mints.

Remember that people had to save something from what they produced to acquire other goods. This real savings/capital is what makes the economy run. The gold is just a medium to trade real savings for goods.

Everything is great. Trade grows with other valleys, coinage expands at a rate equal to production of goods. Peace breaks out with old enemies because trade grows makes everyone’s life better, and George prospers.

George has branched out into other businesses and sends out his many kids to buy raw materials needed to make his products: plows with metal tips, carts, leather shoes, jewelry, and the like. He sends his kids far and wide but it was risky carrying around a lot of gold in far places. So, knowing that everyone knows him and trusts him, he issues documents, certificates that say the bearer of the certificate is entitled to redeem a certain amount of gold coins. George stores the gold in a cave heavily guarded by his sons-in-law. George signs and seals each document and calls them “gold deposit receipts.” People know that if George says he’s got the gold, he does, and they accept them.

George’s kids spread the receipts around, sellers accept them, and he prospers even more. Pretty soon others see the advantage of gold deposit receipts, and they deposit their gold in George’s cave and accept gold receipts. It worked out great and George realized he just created banking. The neat thing is that because the supply of gold was rather limited it was hard for George to flood the market with his paper receipts even if he wanted to. Other than supply and demand issues with goods, prices were stable.

George died and left his successful businesses to his kids; George Jr. gets the cave-bank.

Junior is smart too, but rather greedy. He is known to have a summer home in the mountains by the lake, and has lots of fine horses and carriages. Women find him attractive and he parties a lot. Junior thinks that the business isn’t meeting his cash needs but he has a problem: gold can’t be mined and minted any faster.

Junior has a great idea. He notices that people rarely cash in the gold receipts to take possession of their gold on deposit in the bank. What if, he thought, I start lending out the gold that’s just sitting there? He knew that people only demanded about 10% of the physical gold held at any one time. He realized he could lend more money than he actually had. “Eureka! I’ve figured out a new paradigm in banking. I’m going to call it ‘fractional reserve banking.’ This can’t fail!”

Junior began lending new “certificates” that said the Bank of George would pay the bearer in gold in the named denomination. He wasn’t saying it was a deposit receipt for a specific sack of gold coins, but that he would pay in gold when asked. He had one ton of gold deposited in the cave. He drew up certificates equal to five tons of gold—four more than he had—and proceeded to lend this new money to his customers. He increased the supply of money by 400%. There was no actual real savings or capital created by Junior. No one saved their production, created wealth, and deposited the gold equivalent in the bank; Junior just issued more pieces of paper.

People were pretty happy at first. The tanners, miners, builders, and quarry owners who first borrowed most of the money bid up the price of wages and resources like hides, lumber, stone, iron, copper, and wheat. Trade expanded rapidly with the new certificates floating around. Then people started to notice that prices were going up rather dramatically. By the time the new money worked its way through the valley, the farmers, cobblers, and workers, who were last in the money chain had to pay more for things like bread, housing, cloth, and shoes. Much more.

But … some people noticed that gold coins would buy more than would the certificates. John’s son Johnson brought his certificates into the bank and asked Junior to give him the gold coins. Junior tried to talk him out of it but Johnson was stubborn and got the coins. Other people noticed the same thing and ran to the cave to exchange certificates for gold. In fact, everyone ran to the bank to exchange the certificates for gold. Junior and the bank went bust because he issued certificates for 5 tons of gold but only had one ton. Had just invented inflation. From then on many people kept all of their money in gold. Johnson’s family motto became, “In Gold We Trust.”

You might notice that more pieces of paper didn’t create any wealth. Real savings, you recall, was some consumer good produced that someone didn’t consume. They traded it for gold, a monetary commodity which retained its value. I mean, why would anyone trade their hard earned products for a worthless piece of paper? Just issuing more pieces of paper didn’t do anything except raise prices. It certainly didn’t create “wealth.”

Now leap forward in time. The village has become a big city in a large country. Johnson is old money rich because his family kept gold and invested wisely over the years. George’s family went into banking and over the centuries blew up many times. George went into academia and studied a new kind of economics that said money was whatever the government said it was.

George eventually became the head of the government’s central bank. He once told his mentor, Friedman, that “we’ll never have an economic collapse again because I control money!” The first thing George did was to ban all forms of money as legal tender except the one that the central bank issued—”notes” called the dollar. The dollar was a piece of paper with numbers on it. The second thing he did was to sever the relationship of the dollar with gold or any other commodity. The government had a big army to back up the edicts of Geor

People everywhere in the country loved the dollar but had no clue what it represented. People seemed to want these pieces of paper a lot. They were pretty, green things, well made, and looked very official. People just stopped thinking about what money was.

George kept printing dollars whenever he thought the economy needed a boost. Things were great for a while, and then, as prices inflated he stopped printing and the economy crashed. The government decided to stimulate the economy and embarked on great new projects like dams, bridges, roads, stadiums, government buildings, and other things the leaders wanted. These projects cost billions and billions. The leaders said that the people were complaining and they couldn’t keep raising taxes. “What do we do?” George said, “Leaders, you issue debt, I’ll buy it, and print dollars to pay you. Take the dollars and spend! The economy will recover and everything will be fine.” Which the government did. Pretty soon prices started going up and up and up and the central bank had to print more dollars to keep up with the demand.

Meanwhile, Johnson had a very nice business making gardening and farming tools. But his workers were getting poorer because inflation caused prices to go up and up. He couldn’t raise his prices fast enough to keep up with wage demands. He said to his workers, “Look, I can pay you in dollars, but wouldn’t you like gold instead?” He explained that the dollar was going down in value relative to gold, and gold would buy more. It didn’t matter what the government did to the money as long as they held gold. The workers liked that so he issued gold deposit receipts on the gold he held in a vault deep under his estate. Holders could come in and demand and receive gold in the amount of the receipts. The workers really liked this because the gold held its value and inflation didn’t bother them at all and they all prospered. People started using these receipts all around town.

George heard about this and had Johnson arrested because he violated legal tender laws. Johnson was convicted and thrown in jail and his gold was confiscated. Before he was hanged he gave a speech on the gallows:

“Fellow citizens, you work every day for what? A piece of paper? That piece of paper isn’t wealth or capital. Like our ancestors ten generations back, real wealth was the wheat they produced and saved. They exchanged it for something of value: gold. Gold is money because people value it as a medium of exchange. You’ve forgotten what money really is and now you trade your labor and goods for pieces of paper worth nothing! Now George and his cronies print paper at will to pay for what the government wants. They use it to bail their friends out when they go bust. Their legacy is inflation, just another tax on your labor. Gold, my friends, is the only thing that can prevent the government from inflating the money supply and stealing your wealth. They are destroying our economy. Rebel and demand we go back on a gold standard and have real money. Don’t let ……”

P.S.

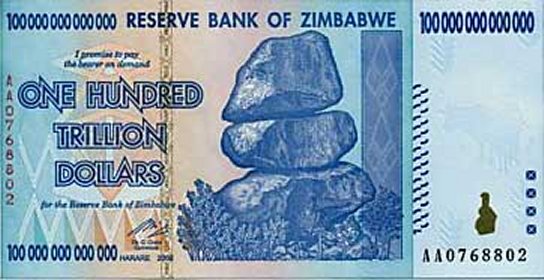

P.P.S. I thought I would throw this in: the largest notes ever printed with the numbers written out. From the private collection of Econophile. Bought on e-Bay for $7.50.

.

Wild Thing’s comment……..

Great article about this.

The market is up because everything else is going up. Groceries cost more and the stocks cost more because the dollar is in the tank.

…. Thank you Jim for sending this to me.

…. Thank you Jim for sending this to me.

Companies are afraid of Obama’s administration, so they lay off and don’t rehire-period. Bills continue to go up and the cost of living is much higher. When you’re on a very limited budget, it makes it hurt all the more. Obama is rubbing salt in the wounds of America and blaming Bush for it. But he wants this to happen, so we go begging the government for help. Is this guy fixed on Oliver Twist? I guess he does want us going, “Please sir, I want some more.” and he will tell us, “NO.” and laugh about it.

You’re absolutely right Lynn. The fable reminds me of Fractured Fairytales on the Rocky and Bullwinkle show. And things are pretty fractured right now.

I have diversified holdings. In the last x weeks I have watched the stock market rise while watching gold also rise. Now gold is over $1000 an ounce. The Euro keeps rising over the Dollar. obama is killing our economy. Inflation will soon be coming with all of it’s attached nightmares.

A good commodity investment right now is ammunition.

Good advice Tom, the Weimar Republic is here again.

Speaking of commodity investments (for those of us who can’t afford gold), I was thinking cigarettes and a bad load of Crown Royal. My wife has been canning food like a fiend.

Yeah Rocky and Bullwinkle, now we have Boris and Natasha in the white house. Yeah, the market is rising but it doesn’t seem to be that stable. Fluctuating up one day then down the next. Tells me the guys at the market don’t know what to think and don’t trust obama.

Thank you so much all of you.

Mark I used to love the cartoon when I was

a kid. Your righit that is who we have now

and I only liked it as a cartoon.