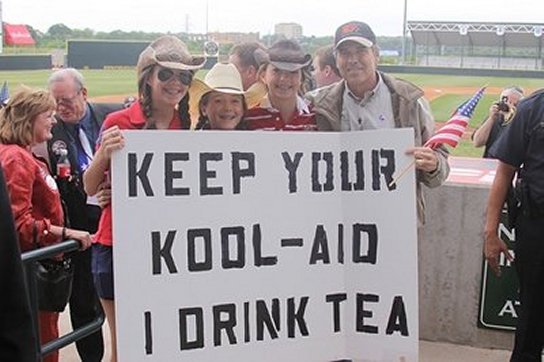

Rick Perry some TEA Party participants in Fort Worth who refuse to drink the Washington Kool-Aid ( 2010)

Perry Flat Tax Plan Wins Conservative Fans

Newsmax

Texas Gov. Rick Perry was widely praised by conservatives on Tuesday as he issued his flat tax plan which he hopes will revive his struggling campaign for the White House.

The plan, which reduces corporate and income taxes to 20 percent, would “immediately add trillions of dollars in new wealth to the economy,” Club for Growth president Chris Chocola said, while of Americans for Tax Reform leader Grover Norquist called it “a great step forward.”

The plan would allow taxpayers to pay at the current rates or to adopt the flat tax plan. During his speech Perry waved a postcard saying that would be the size of the average American’s tax return as he compared it with a tax code of 72,000 pages. He claimed the plan’s very simplicity would save $483 billion in tax compliance costs.

“Each individual taxpayer will have a choice,” he said. “You can continue to pay your taxes, as well as the lawyers and accountants, or you can file on a postcard.”

Perry’s plan also eliminates the death tax and taxes on social security payments, while maintaining deductions for mortgage interest, charitable giving and state and local taxes for families earning less than $500,000. It increases standard deductions to $12,500. It also gets rid of the long-tern capital gains tax.

It would give corporations a one-off opportunity to repatriate earnings from abroad – which he estimated at $1.4 trillion – with a reduced tax rate of 5.25 percent. He called that, “The kind of economic stimulus that President Obama could have achieved if he wasn’t so hell-bent on passing big government schemes that have failed American worker.”

Perry said his plan would “shut down the cottage industry of corporate tax evasion,” and offer an incentive for companies to invest once more in America.

“The flat tax will unleash growth, but growth is not enough,” said Perry in his speech. “We must put a stop to this entitlement culture that risks the financial solvency of this country for future generations.”

He said every child born in America immediately owes the federal government $46,000.

In his Wall Street Journal article Perry said, “Fixing America’s tax, spending and entitlement cultures will not be easy. But the status quo of byzantine taxes, loose spending and the perpetual delay of entitlement reform is a recipe for disaster.

“Cut, Balance and Grow strikes a major blow against the Washington-knows-best mindset. It takes money from spendthrift bureaucrats and returns it to families. It puts fewer job-killing regulations on employers and more restrictions on politicians. It gives more freedom to Americans to control their own destiny. And just as importantly, the Cut, Balance and Grow plan paves the way for the job creation, balanced budgets and fiscal responsibility we need to get America working again.”

Chocola immediately hailed the proposal. “A Flat Tax like the one proposed by Perry would unleash years of economic growth if it is passed into law,” he said.

“Perry clearly understands that revitalizing the economy should start with a complete overhaul of a tax code that has nearly choked economic growth to death. Conservatives looking for a champion to carry the banner of a pro-growth tax reform will surely rally behind this bold proposal.”

Norquist tweeted his reaction. “TX Governor Rick Perry’s flat tax alternative is great step forward. Doesn’t create a VAT or sales tax that could grow.”

In a second tweet, Norquist added, “Perry’s flat tax has the classic lines of a Steve Jobs’ product. Seamless. ….and Steve Forbes likes it. I’ll take two.”

Forbes – who ran for president on the GOP ticket in 1996 and 2000 with a flat tax as his main platform – is an adviser to Perry and helped draw up the plan. He called it a “win-win all around,” because of its simplicity.

Forbes said the time has come for a flat tax. “People want it, they hunger for it,” he told Fox News. “You saw the reaction to Herman Cain’s plan, even with the sales tax part of it. Rick Perry does not have a sales tax, which is going to make the plan even more appealing.” “It’s going to be very exciting,” he added. “A very low rate, generous exemptions for adults and for children, make it worthwhile to invest in America again, drastically simplifying the tax code, lowering the corporate tax rate.”

CATO scholar Daniel J. Mitchell has reviewed the plan, and gives Perry a solid B+: “As a long-time advocate of a pure flat tax, I’m not happy that Perry has deviated from the ideal approach. But the perfect should not be the enemy of the very good. If implemented, his plan would dramatically boost economic performance and improve competitiveness. All things considered, though, I prefer the flat tax. The 9-9-9 plan combines a 9 percent flat tax with a 9 percent VAT and a 9 percent national sales tax, and I don’t trust that politicians will keep the rates at 9 percent. The worst thing that can happen with a flat tax is that we degenerate back to the current system. The worst thing that happens with the 9-9-9 plan, as I explain in this video, is that politicians pull a bait-and-switch and America becomes Greece or France.” Source CATO Institute

.

Wild Thing’s comment……..

These are some wonderful quotes about Perry’s tax plan.

So we have two awesome plans from Perry…his energy one and this one regarding tax. I am thrilled with both of them.

While taking a tax class provided by the IRS, we had an IRS supervisor tell us that a Flat Tax would be the fairest and simplest thing for the America People. He also went on to say that a Flat Tax will never be implemented. He said implementing a simple Flat Tax system would literally put millions of people out of work. Millions of Americans earn their living by our tax system. This includes CPA’s, IRS agents, software programers, tax agencies like H&R Block, etc.

the flat tax program has my vote! 🙂

We have needed a flat tax system for decades. We have not had one because career politicians have padded their pockets and kept their political seats by selling their influence to lobbiests and influential special interests.