11 am EST economic speech in Gray Court, SC and 3 pm ET press conference at the statehouse in Coumbia, SC.

MEDIA ADVISORY

Tuesday, Oct. 25

** On Tuesday morning, Gov. Perry will unveil the next pillar of his jobs/economic plan at ISO Poly Films and later in the afternoon he will hold a press conference at the South Carolina State House.

You can tune in this morning at 11a.m. Eastern for live stream live video of our “Cut, Balance and Grow” announcement: http://rickperry.org/

** He is also scheduled for an interview on the Bill O’Reilly show on FOX News Tuesday night.

( tonight)

.

My Tax and Spending Reform Plan

Individuals will have the option of paying a 20% flat-rate income tax and I’ll cap spending at 18% of GDP..

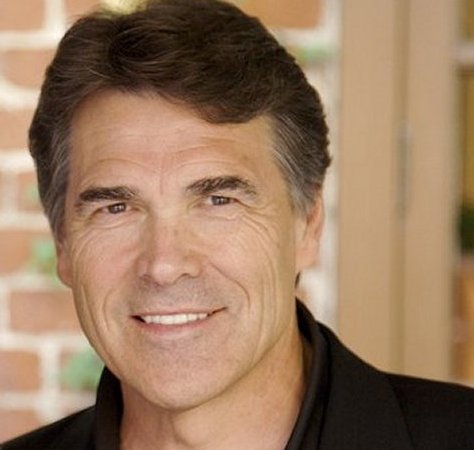

By RICK PERRY

The Wall Street Journal

The folks in Washington might not like to hear it, but the plain truth is the U.S. government spends too much. Taxes are too high, too complex, and too riddled with special interest loopholes. And our expensive entitlement system is unsustainable in the long run.

Without significant change quickly, our nation will go the way of some in Europe: mired in debt and unable to pay our bills. President Obama and many in Washington seem unable or unwilling to tackle these issues, either out of fear of alienating the left or because they want Americans to be dependent on big government.

On Tuesday I will announce my “Cut, Balance and Grow” plan to scrap the current tax code, lower and simplify tax rates, cut spending and balance the federal budget, reform entitlements, and grow jobs and economic opportunity.

The plan starts with giving Americans a choice between a new, flat tax rate of 20% or their current income tax rate. The new flat tax preserves mortgage interest, charitable and state and local tax exemptions for families earning less than $500,000 annually, and it increases the standard deduction to $12,500 for individuals and dependents.

This simple 20% flat tax will allow Americans to file their taxes on a postcard, saving up to $483 billion in compliance costs. By eliminating the dozens of carve-outs that make the current code so incomprehensible, we will renew incentives for entrepreneurial risk-taking and investment that creates jobs, inspires Americans to work hard and forms the foundation of a strong economy. My plan also abolishes the death tax once and for all, providing needed certainty to American family farms and small businesses.

My plan restores American competitiveness in the global marketplace and provides strong incentives for U.S.-based employers to build new factories and create thousands of jobs here at home.

First, we will lower the corporate tax rate to 20%—dropping it from the second highest in the developed world to a rate on par with our global competitors. Second, we will encourage the swift repatriation of some of the $1.4 trillion estimated to be parked overseas by temporarily lowering the rate to 5.25%. And third, we will transition to a “territorial tax system”—as seen in Hong Kong and France, for example—that only taxes in-country income.

The mind-boggling complexity of the current tax code helps large corporations with lawyers and accountants devise the best tax-avoidance strategies money can buy. That is why Cut, Balance and Grow also phases out corporate loopholes and special-interest tax breaks to provide a level playing field for employers of all sizes.

To help older Americans, we will eliminate the tax on Social Security benefits, boosting the incomes of 17 million current beneficiaries who see their benefits taxed if they continue to work and earn income in addition to Social Security earnings.

We will eliminate the tax on qualified dividends and long-term capital gains to free up the billions of dollars Americans are sitting on to avoid taxes on the gain.

All of these tax cuts will be meaningless if we do not control federal spending. Last year the government spent $1.3 trillion more than it collected, and total federal debt now approaches $15 trillion. By the end of 2011, the Office of Management and Budget expects the gross amount of federal debt to exceed the size of America’s entire economy for the first time in over 65 years.

Under my plan, we will establish a clear goal of balancing the budget by 2020. It will be an extremely difficult task exacerbated by the current economic crisis and our need for significant tax cuts to spur growth. But that growth is what will get us to balance, if we are willing to make the hard decisions of cutting.

We should start moving toward fiscal responsibility by capping federal spending at 18% of our gross domestic product, banning earmarks and future bailouts, and passing a Balanced Budget Amendment to the Constitution. My plan freezes federal civilian hiring and salaries until the budget is balanced. And to fix the regulatory excess of the Obama administration and its predecessors, my plan puts an immediate moratorium on pending federal regulations and provides a full audit of all regulations passed since 2008 to determine their need, impact and effect on job creation.

ObamaCare, Dodd-Frank and Section 404 of Sarbanes-Oxley must be quickly repealed and, if necessary, replaced by market-oriented, common-sense measures.

America must also once and for all face up to entitlement reform. To preserve benefits for current and near-term Social Security beneficiaries, my plan permanently stops politicians from raiding the program’s trust fund. Congressional IOUs are no substitute for workers’ Social Security payments. We should use the federal Highway Trust Fund as a model for protecting the integrity of a pay-as-you-go system.

Cut, Balance and Grow also gives younger workers the option to own their Social Security contributions through personal retirement accounts that Washington politicians can never raid. Because young workers will own their contributions, they will be free to seek a market rate of return if they choose, and to leave their retirement savings to their dependents when they die.

Fixing America’s tax, spending and entitlement cultures will not be easy. But the status quo of byzantine taxes, loose spending and the perpetual delay of entitlement reform is a recipe for disaster.

Cut, Balance and Grow strikes a major blow against the Washington-knows-best mindset. It takes money from spendthrift bureaucrats and returns it to families. It puts fewer job-killing regulations on employers and more restrictions on politicians. It gives more freedom to Americans to control their own destiny. And just as importantly, the Cut, Balance and Grow plan paves the way for the job creation, balanced budgets and fiscal responsibility we need to get America working again.

.

Wild Thing’s comment……..

I am also hoping they put what he says on a YouTube and if they do I will post it as well.

He’s done good for Texas.

The “Cut,Balance and Grow” plan is very similar to the “Cut, Cap and Balance”, bill submitted by and passed, by the Republicans in the House, a while back. The Democrats, in the Senate, under Harry Reid’s leadership, never let it be heard, and therefore it died.

It is good to see Mr. Perry advancing the idea again. Combine this with his earlier Flat Tax proposal, and you have a man who has some very viable solutions to solving the Financial Crisis, this Country finds itself in.

The damage that this Administration and Democratic Controlled Congress has done to the Economy, over the past 7 years cannot be expected to be undone in any shorter period of time.

That being said, if and wnen proposals, such as Mr. Perry’s, are adopted and put to work, the signs of some sort of recovery will be immediate. Banks will be much more willing to allow for easier loans once they know, and can be assured as to what is going to happen in the near future. Small Business owners will be able survive and continue to grow as well.

One only has to look at what has happened in the economy in Texas, since this man has been the Governor, to see that this man knows what he is talking about.

Excellent plan. Exactly what is needed. Good for small/medium business and good for individuals.

CPAs won’t like it because it allows individuals to rapidly figure out their taxes. Liberals will hate it because it is anti socialist and government limiting. They will probably call it racist.

I am particularly happy to see that Perry would eliminate the estate tax for good.

The MSM is going to attack and ridicule Perry’s tax and reform plan with a vengence. They will see it as a plan to replace socialism and big govt. with free market capitalism and individual responsibility. Romney will claim faults with this plan and the GOP/RNC will not support it.

Perry’s support of The US Constitution, especially it’s 2nd and 10th Amendments, and his economic common sense are enough reason for me to support him over the other GOP candidates.

Thank you all for your input,I appreciate it.