Study: Cain Tax Plan Raises Taxes on 84 Percent

FOX News

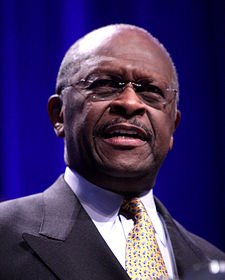

Herman Cain’s 9-9-9 tax plan would raise taxes on 84 percent of U.S. households, according to an independent analysis released Tuesday, contradicting claims by the Republican presidential candidate that most Americans would see a tax cut.

The Tax Policy Center, a Washington think tank, says low- and middle-income families would be hit hardest, with households making between $10,000 and $20,000 seeing their taxes increase by nearly 950 percent.

“You’re talking a $2,700 tax increase for people with incomes between $10,000 and $20,000,” said Roberton Williams, a senior fellow at the Tax Policy Center. “That’s huge.”

Households with the highest incomes, however, would get big tax cuts. Those making more than $1 million a year would see their taxes cut nearly in half, on average, according to the analysis.

Among those in the middle, households making between $40,000 and $50,000 would see their taxes increase by an average of $4,400, the report said. Those making between $50,000 and $75,000 would see their annual tax bill go up by an average of $4,326.

“It’s very, very regressive compared to the current system, and that’s largely because we’re exempting capital gains, and we’re taxing your spending with the sales tax,” Williams said.

“People at the top end don’t spend all their money and they get a lot of capital gains, so they are doing pretty well here.”

Cain’s campaign did not immediately respond to a request for comment. In the past, Cain has acknowledged that taxes would increase for some but says taxes would decrease for most.

“Some people will pay more, but most people would pay less is my argument,” Cain said Sunday on NBC’s “Meet the Press.” “Who will pay more? The people who spend more money on new goods. The sales tax only applies to people who buy new goods, not used goods. That’s a big difference that doesn’t come out.”

Cain’s plan would scrap current taxes on income, payroll, capital gains and corporate profits. He would replace them with a 9 percent tax on income, a 9 percent business tax and a 9 percent national sales tax.

Cain’s campaign has gained momentum largely in response to his tax plan, which is popular in part because of its simplicity. Several polls have the former CEO of Godfather’s Pizza at or near the top of the Republican field, vying with former Massachusetts Gov. Mitt Romney.

President Barack Obama told ABC News that Cain’s tax plan would impose a “huge burden” on middle-class and working families. The president said Cain’s plan would make sure the wealthiest pay less — and replace the revenue with a sales tax hitting the less well-off.

Romney criticized the plan in a conference call with reporters Tuesday.

“I believe that you’re going to find with the 9-9-9 plan Herman Cain has put out that the burden shifts more to the middle class, and I think that’s the wrong direction to go,” Romney said. “A decision to completely jettison our current tax system for a new system always has some merit, but then you need to get into it, to figure out who’s this going to help and who’s this going to hurt.”

Cain’s rise in the polls has brought increased scrutiny, and his tax plan has taken hits from across the political spectrum. Some don’t like shifting the tax burden from the wealthy to the poor and middle class; others don’t like the new national sales tax.

“Adding a retail sales tax to the federal government’s powerful tax armada would be a terrible idea from a small-government perspective,” Chris Edwards of the libertarian Cato Institute wrote in an opinion piece for The Daily Caller website.

William McBride, an economist at the conservative Tax Foundation, said Cain’s plan to move away from taxing savings and investment “would be a very good thing for growth in the long run.”

But, McBride said, the national sales tax would be a nightmare to administer because so many state and local governments already have sales taxes, and the bases are different.

In most states, food and medicine are excluded from sales tax. Cain has said his sales tax would be applied to all new goods — only used goods would be exempt.

“It’s not as simple as having all these jurisdictions simply tack on 9 percent and send it to the federal government,” McBride said in an interview.

Cain has said his plan would initially raise as much money as the current tax system but do it more efficiently, leading to economic growth, which would produce higher tax revenues. The Tax Policy Center analysis agreed that the plan would initially raise about the same amount of money as current tax policy, about $2.55 trillion in 2013.

The Tax Policy Center compared taxes on U.S. households under current tax policy, with those imposed under the Cain plan. In using current tax policy, the analysis assumes that tax cuts enacted under former President George W. Bush — and extended through 2012 by Obama — would be extended.

The center did a separate analysis that assumed all the Bush-era tax cuts would expire at the end of 2012. Under that scenario, Cain’s plan would still impose higher taxes on 77 percent of U.S. households, the report said.

The Tax Policy Center is a research group formed by two Washington think tanks: the Urban Institute and the Brookings Institution. Researchers at the center regularly testify before Congress on tax policy. The center’s analyses during the 2008 presidential campaign were widely circulated.

The center said researchers tried to consult with Cain’s advisers to make sure they were interpreting the plan correctly, but they had not heard back.

.

Wild Thing’s comment……

During the debate Cain kept repeating ” apples and oranges” instead of being clear on an answer to explain his plan. Several of the candidates kept asking Cain to make it more clear and he just kept saying apples and oranges. weird. My husband Nick said when this was all happening, Cain is confusing people and it’s not good.