TARP, the Troubled Asset Relief Program (TARP) is a program of the United States government to purchase assets and equity from financial institutions to strengthen its financial sector that was signed into law by U.S. President George W. Bush on October 3, 2008. It was a component of the government’s measures in 2008 to address the subprime mortgage crisis.

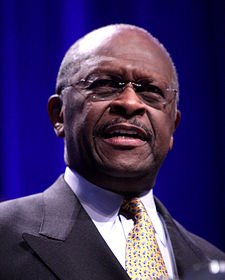

Herman Cain’s position on TARP:

On October 20, 2008, Herman Cain wrote, in an article in North Star Writers Group’s

Far from Nationalization, Purchase of Bank Stocks Is a Win-Win for Taxpayers

Earth to taxpayers! Owning stocks in banks is not nationalization of the banking industry. It’s trying to solve a problem.

The unprecedented financial crisis has caused the Treasury of the United States to take unprecedented measures to help solve the problem of frozen credit and cash flow for U.S. businesses.

Most of us had dreams of what we wanted to be when we grew up as children. Some of us wanted to grow up and become a fireman, a policeman, a doctor, a nurse, a lawyer, a teacher, an actor, an engineer, a writer, a dancer, a chef or any number of other professions.

But some of us wanted to own a bank because that’s where the money is!

Wake up people! Owning a part of the major banks in America is not a bad thing. We could make a profit while solving a problem.

But the mainstream media and the free market purists want you to believe that this is the end of capitalism as we know it. It is not for several reasons that they have conveniently not explained.

First, instead of buying toxic mortgage-related assets of banks as originally proposed, the Treasury has changed tactics and will buy equity positions called preferred stocks, which gives us as taxpayers an ownership stake in their success for a limited period of time.

Preferred stock means we get paid a dividend before any other stockholders get paid a dividend when they make a profit. You got a problem with that?

Second, the purchase agreement between the Treasury and the participating banks has an incentive for the banks to re-purchase the stock back from the Treasury within five years.

If the banks do not re-purchase the stock in five years then we get a bigger dividend until they do re-purchase the stock. That’s a good deal!

The free market purists’ objection to this is that it smacks at government control of the banking industry, which is called nationalization. They are correct. It smacks, but it is not nationalization because that would require the government to own at least 51 percent of the entity for an indefinite period of time.

The ownership by the taxpayers is going to be relatively small and nowhere near the amount needed to be called nationalization. So what’s the problem?

The problem is economic illiteracy and media incompetence. Some people want to continue to fan the flames of anger and outrage over how we got into this mess in the first place. Anger and outrage will not solve the problem.

Unprecedented problems require unprecedented solutions. The actions by the Treasury are a win-win for the taxpayer. But the mainstream media does not get brownie points for reporting win-win solutions for the taxpayers. Their focus is doom and gloom.

These actions by the Treasury, the Federal Reserve Bank and the actions by the Federal Depositors Insurance Corporation (FDIC) are all intended to help solve an unprecedented financial crisis. Unlike steps taken prior to and during the Great Depression, these actions have a high probability of success.

In order for these collective actions to work, the media needs to calm its crisis rhetoric, and Congress needs to just shut up with its political rhetoric.

Now don’t tell Nancy Pelosi and Harry Reid, but if this works, and I believe it will, the Bush Administration will have gotten this one right.

As we say in the South, y’all hush!

.

Cain’s TARP talk, praise of the Fed could hurt him with conservative voters

The Hill

Businessman Herman Cain has shot to the top of the polls with support from Tea Party members, but his backing of the Troubled Asset Relief Program and opposition to auditing the Federal Reserve could hurt him with those same voters.

Levi Russell, the spokesman for the fiscally conservative group Americans for Prosperity, said that Cain will have to explain his stances on these issues if he is to remain a first-tier candidate.

“Among the Tea Party audience, the TARP bailout is something they’re adamantly against, and they’re going to absolutely need to hear more from him on this issue to be comfortable with him,” said Russell. “I don’t know one Tea Party activist who’d say it’s a bad idea to audit the Fed, that’s not a popular position for him to be staking out.”

Cain served as chairman of the Kansas City Federal Reserve in the mid-1990s and, in Tuesday’s debate, expressed his admiration for former Reserve Chairman Alan Greenspan.

“The way Alan Greenspan oversaw the Fed and the way he coordinated with all of the Federal Reserve banks, I think that it worked fine back in the early 1990s,” Cain said.

Cain’s praise of Greenspan drew a sharp rebuke from Paul, who called the former chairman a “disaster” — to loud cheers from the audience.

At another point, Paul quoted Cain as calling those who wanted to audit the Fed “ignorant.” Cain said he was being misquoted, but that quote has been unearthed and verified.

“I think it is going to hurt him,” Ivers said. “He’s contradicting himself, he’s making false claims to say there’s nothing to learn and it’s going to hurt him in Iowa.”

Craig Robinson, a former Iowa Republican Party political director who now runs the influential conservative news website The Iowa Republican, agreed that those issues could hurt Cain.

“Just like Rick Perry was vetted through these debates, Cain will be vetted through his debate performances and what he said in news interviews,” he said. “Some of the things he said, especially the Greenspan stuff, is really out of line with the Tea Party movement, and at some point that will come home to roost.”

.

Wild Thing’s comment……..

Sharing informaion on Cain so we know as much about him as possible.

As Herman Cain was on one of the Federal Reserve Bank boards he is offering a professional opinion with a quantifiable monetary value.

Only Dr. Ron Paul comes close to having his background knowledge and frankly is not as concerned with making things work as Herman Cain. When those two disagree and go deep to argue it is like watching submarine races but when they both are in full agreement that something is wrong we should fully trust them.

Avitar, thanks for your input.

TARP is a done deal and was only a band aid. Nothing can be done about it now. I wish people would talk up the root cause of the problem to solve, which is the CRA, freddy and fanny (and a few more complex things). They all need to be abolished. What the government has done to address the first great depression of the 21st centary is not a cure while CRA/F/F all float merrily along as if nothing had ever happened.