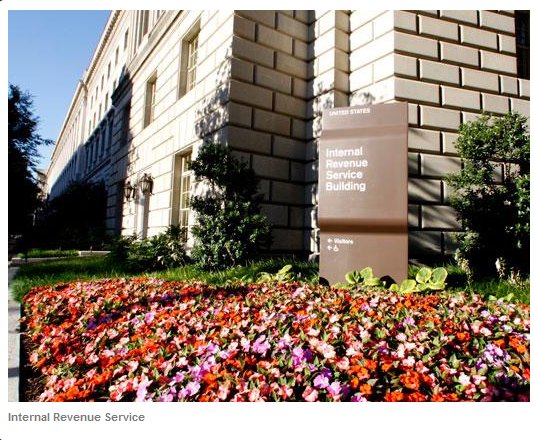

America to have the highest corporate tax rate in April

The Daily Caller

The world’s superpower is about to lead the way in yet another realm. Next month, America is set to bear the distinction of having the highest corporate tax rate in the industrialized world.

According to a study by the Tax Foundation, America’s combined federal and state rate of 39.2 percent is only out paced by Japan’s rate of 39.5 percent – which Japan plans to lower next month. Without Japan in the lead, America’s 39.2 percent will render it the corporate tax rate leader in the developed world, aka the countries comprising the Organization for Economic Cooperation and Development (OECD).

In recent years, many OECD nations have been lowering their corporate income tax to create more favorable environments for business. The Tax Foundation notes that since 2000 Germany, Canada, Greece, Turkey, Poland, the Slovak Republic, Iceland, and Ireland have all lowered their corporate tax rates by double-digits.

The study’s author and Tax Foundation president Scott A. Hodge said that one of America’s economic pitfalls will be the high corporate income tax.

“United States companies are now in the position of trying to compete in the 21st century world economy with a 20th century tax system,” said Ho. “Dozens of countries around the world—including many of the United States’ closest trading partners—have realized that sky-high corporate tax rates are an economic dead end. Now more than ever, Americans want to see policies that will help create increased growth, more jobs, and higher standards of living – exactly the things that a lower and more streamlined corporate tax system can help achieve.”

The Tax Foundation’s study adds fodder to a similar warning that came from the Cato Institute in February. Cato advised that the U.S. reduce its corporate tax burden by 10 percent or more.

“A growing number of policymakers are recognizing that the U.S. corporate tax system is a major barrier to economic growth,” Duanjie Chen and Jack Mintz wrote in a Cato bulletin. “The aim of corporate tax reforms should be to create a system that has a competitive rate and is neutral between different business activities.”

Wild Thing’s comment……..

Notice how all the bad things our country is getting to be number one with and all the good things America meant to the world and especially we the people ( since obama got his brubby hands on our country) have turned upside down and backward. sheesh

The more this destruction keeps up there will be a day when another devastation like the one in Japan happens and we will not be able to help at all. The shining light on the hill Reagan spoke of will exist in our hearts but not as a country to the world. We have GOT to take our country back!!!!!!!!!!!!!!!!!

Corp Taxes benefit no one but the Government. It destroys our nations ability to compete in the World Market.

People will wonder why more corporations pack up and move to China and Mexico.

I agree.

Corporate taxes, federal, state, and local are just another cost of doing business and end up being paid by the consumer in higher costs for products and services from those businesses that survive.

Government grows unsustainably and the private sector shrinks and can’t compete as well.

We need to do the reverse to achieve prosperity at home and peace abroad. Expand and grow the private sector thereby expanding the tax base by growing the economy making it dynamic, not static. Make the pie bigger and bigger for everyone.

The corporate tax rate has been a peeve of mine for years. Especially when I buy something made in China that used to be made in the USA. I thought in 2000 when Repubs had the presidency and both houses of Congress that the corporate tax rate would decrease. Instead, it grew. we have lost much of our industrial/manufacturing base to foreign companies. Even items needed by the Defense dept. have to be purchased from overseas suppliers. We need to lower the tax rate to a single digit number. We need those jobs back in America.

Thank you all for your input about this, I really appreciate it.