Cain’s Sales Tax Would Hurt Consumer Spending

Bloomberg

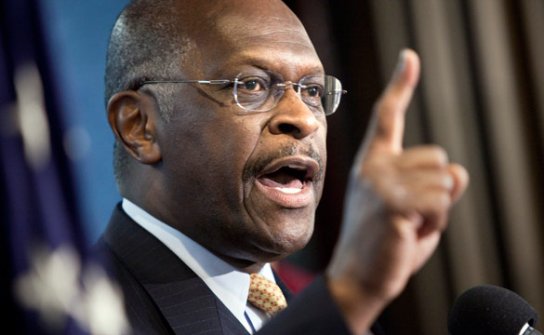

Republican presidential candidate Herman Cain’s plan to create a national sales tax would hurt retailers, threaten economic growth and shift the tax burden onto the middle class and poor, tax experts and business groups said.

Cain’s so-called 9-9-9 plan, which would replace the current tax code with a system of three separate taxes of 9 percent each, has boosted his popularity among voters. The former chief executive officer of Godfather’s Pizza has surged in polls in recent weeks, and a Wall Street Journal/NBC News poll released this week put him in the lead.

Tax experts and business groups interviewed yesterday don’t like his tax plan as much as voters. They said it would shift the burden to middle-income and poor families and would hurt sales across the economy, at least in the short term.

“There will be a noticeable decline in consumer spending for some years,” said Rachelle Bernstein, vice president of the National Retail Federation, based in Washington, in an interview. “We know that that has an impact on consumer spending and GDP.”

Consumer spending accounts for about 70 percent of the U.S. gross domestic product.

Cain has proposed a 9 percent sales tax on all goods and services, another 9 percent on personal income and the third on corporate gross income. During the debate in New Hampshire sponsored by Bloomberg News and the Washington Post/

Conotimue article please CLICK HERE, thank you.

.

Wild Thing’s comment……

The more I learn about the 9-9-9 plan the more I do not like it at all. Cain’s plan is a deal-breaker for most senior citizens The 9-9-9 plan will not fly with retirees, and that’s probably the largest voting block in this country, AND GROWING FAST! My response to 9-9-9 is no. He apparently hasn’t thought through the implications of it.

Also Cain seriously needs to clarify his conception of individual state’s laws regarding the Second Amendment.

I’m a flat tax supporter. All taxpayers pay the same rate. The national sales tax(consumption tax) sounds good at first because every single American would pay federal taxes. But, like you point out WT, it would not be fair to retirees who take a big income loss when they retire.

We need to do something to simplify the horrendously complex tax code we now have. It actually costs us tax revenue. Any number of politicians have campaigned on lessening the pages of the US Tax Code, but it continues to grow.

Cain’s flaw is that he wants to add the federal sales tax as an additional tax to the income tax. He has also said nothing about putting a cap on any of his three taxes.

We also need to slash the US Corporate Tax by at least 2/3rds to return lost jobs to America. I am still wondering why Dubya, who has an MBA, did nothing to reduce that terrible tax.

Chrissie

We can’t go on with the American trade deficit where it is. And as long as the American manufactures have to pay all of the taxes we are going to be headed for down the toilet. Walk around Wal-Mart and estimate how many things bought take money out of the economy and into china.

I would prefer to repeal the 16th amendment and have the federal Government surtax the state property taxes so the stupid states would be paying twice but neither of those are going to happen. As long as we build a tax on labor in every product America sells we are in decline.

I would go for a 5-5-5 plan. 5% of GDP in peace time reserved for the military and anything left can be used for research and development or space exploration.

5% for conventional Government operations, Airport operations road building exedra

The final 5% maximum of GDP for pensions welfare payments

An absolute cap of 15% federal taxes except taxes for paying down war bonds.

None of that is going to happen. Robbing, looting and pillaging together with a little recreational brigandage is what the Democrats see the Government as being for. Be kind to Herman Cain he is working in a fantasy world where we don’t have to shot certain liberals to save the country.

HUGE thank you to both of you. I sure do appreciate your input about this.

A quick post script to TomR Dubya did do something about the corporate tax and about opening oil exploration around the country. It also got through the House but was blocked by a team of RINOS and Democrats in the Senate. It stayed tied up in committee for eight years. Newt got it to Clinton’s desk in his four years but the dumb hick vetoed both initives. Not surprising as Clinton’s ’93 congress hiked the tax and banned the drilling.