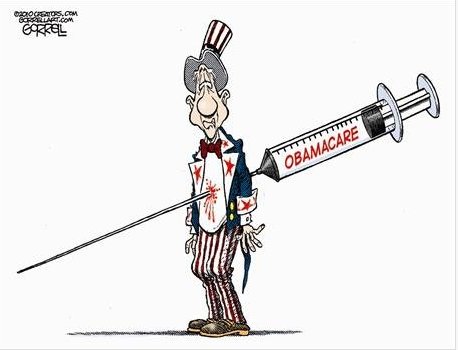

The Bitter Fruit of ObamaCare

Expose Obama

By Floyd Brown

Get ready for your life to change. The so-called benefits of ObamaCare don’t start until 2014, but the tax increases, misallocated resources and federal regulations start now.

Speaker Nancy Pelosi famously said the night of ObamCare’s passage, “We have to pass the bill so that you can find out what is in it …” The emerging picture is frightening.

ObamaCare dramatically alters the already-overregulated health insurance market. The federal government will now manage your health care decisions. The law creates a maze of mandates, federal directives, price controls, tax increases and subsidies.

We all begin paying ObamaCare taxes this year. The law includes at last count at least 19 new taxes. As Americans begin to reap the personal financial burden of Obamacare, the movement to repeal it is mounting.

Individuals must pay an annual penalty of $695, or up to 2.5 percent of their annual income, if they don’t purchase an approved health insurance plan. Penalties on families include an annual penalty of $347 per child, up to $2,250 per family, if parents don’t purchase an approved policy.

Most of us have heard about the penalties on employers. Business owners must buy a government -approved health plan or pay a penalty of $2,000 per employee if they have 50 employees or more.

Investors get whacked hard. ObamaCare imposes a 3.8 percent tax on investment income for individuals making $200,000 or more and on families making $250,000 or more. The investment tax is not indexed for inflation, so as time passes more people will be expected to pay. Seniors on fixed incomes and pensioners with IRAs and 401(k) plans will be hit hard.

The so-called “Tax on ‘Cadillac’ health plans” imposes a 40 percent tax on health care plans valued at $10,200 for individuals and $27,500 for families.

Medicare taxes are climbing up, too. The bill requires single people earning $200,000 or more and couples earning $250,000 or more to pay an additional 0.9 percent in Medicare taxes.

Thinking about downsizing or buying a new home? There are new taxes on home sales tacked on the bill. ObamaCare imposes a 3.8 percent tax on home sales and other real estate transactions. Almost every homeowner qualifies as “rich” for one day, the day they sell their house.

Taxes on medical devices will also be going up to 2.9 percent under ObamaCare.

And we can’t forget the new 10 percent tax on tanning.

ObamaCare empowers the IRS for enforcement. The IRS is hiring 16,500 new enforcement officials. The IRS will confiscate tax refunds, place liens on property and seek jail time if healthcare penalties and taxes are not paid.

But don’t despair. As of July 14,130 members of Congress have signed a discharge petition that will force Nancy Pelosi to hold a straight up-or-down vote on HR 4972, a bill, proposed by Congressman Steve King, that repeals ObamaCare

In plain language, that means that the repeal of ObamaCare is actually within our grasp. Congressman King is upbeat, saying: “I am optimistic that we will be able to attract the 218 signatures we will need to force a vote on repealing ObamaCare. … Signatures on the discharge petition have come more quickly than I had expected.”

Wild Thing’s comment…….

The American people will rise up in righteous anger over these monstrosities. A total revolution on 2 November! Failing that…a total revolution!

Everything conneceted with the Obama administration is corrupted.

….Thank you Mark for sending this to me.

….Thank you Mark for sending this to me.

Mark

3rd Mar.Div. 1st Battalion 9th Marine Regiment

1/9 Marines aka The Walking Dead

VN 66-67

Bleed us to servitude through massive taxation. Own us by owning our earnings. Socialism.

I hope that Nancy and the Dems can’t stop the vote on HR4972.

Tom, I agree so much. I never worried before like I have been, between obamacare and the possible cap and trade, it has me really worried.